Set up Tax Rules

Introduction

If your business ships products within Europe or internationally, understanding how VAT (Value Added Tax) applies is essential. VAT obligations apply whether you're located inside or outside the EU. Additionally, even within a single country—like the USA—tax rates may vary by state. This guide will help you set up taxes properly in circuly to ensure compliant and accurate billing.

Note: If you're operating in the USA, circuly offers an integration with TaxJar for automated tax calculations. Reach out to the service desk to activate this integration.

Key concepts

- Value Added Tax (VAT)

VAT is a consumption tax charged as a percentage of the value of goods and services purchased by consumers. VAT applies to nearly all goods and services, but different products may be subject to different tax rates depending on their category.

- VAT regulations for cross-border sales within the EU

The EU has set a threshold amount for businesses situated within the EU selling to customers in another EU country:

- If the business generates less than €10,000 in revenue from sales in another EU country, it charges VAT based on the country where it is registered.

- Once the business reaches the threshold, it must charge VAT based on the country where the customer is located.

- Factors influencing VAT calculation and application

As mentioned above, the VAT is calculated and applied on the basis of three things:

- The category of the product - different products fall under different product categories and are therefore subject to the tax rates of the respective category.

- The country you plan on shipping to - if the minimum threshold amount is reached then the tax rates of the country you are shipping to apply.

- Whether or not the threshold amount has been reached - if the threshold amount has been reached then the tax rates of the country you are shipping to applies. If the threshold amount has not been reached yet then the tax rates of the country you are located in apply.

Note: If you are below the threshold you can choose to apply the tax rates of either the country you are located in or the country you are shipping to.

- When tax configuration is not required

You do not need to configure tax rates if:

- Your business operates in only one country.

- You do not have different tax categories for your rental products.

- Tax rates remain the same regardless of the shipping destination.

Feature Overview

With this feature you can set up tax logics that apply to different categories of products based on the different factors that influence it. This features enables you to assign the right taxes to the products. Before you begin setting up the taxes make sure you have set up the following:

Step-by-step setup guide

- Prerequisite: Define base country, delivery country and product collection

- Set up tax rules

Prerequisite: Define base country and delivery country

Before getting started with the tax rate set up you need to do the following:

- Define your base country: The base country is treated as your default country for tax calculation in case the minimum threshold has not been reached in the long-distance shipping country (the country you are shipping to).

In your circuly Hub > Go to the Settings Tab > Company Settings > Company data > In the Country dropdown menu select your default country > To save your changes, scroll to the bottom of the page and click on the Save changes button.

- Define your delivery countries: When you define your delivery country, a new country column is added to the Tax rules tab so that you can assign the tax percentages to the product collections.

In your circuly Hub > Go to the Settings Tab > Checkout > DELIVERY > Scroll to Delivery countries and select your delivery countries from the dropdown menu > To save your changes click on on the Save changes button.

Note: If you do not set up the delivery countries in the Settings, you will only see the tax collection from the country that you have entered in your company address (company settings). As a result you will not be able to set up tax rules in the Products tab for countries that have different tax percentages and where you want to offer shipping.

Step 1: Create Product Collections

By default, all products are mapped to the default product collection. If you offer products that fall under different tax categories (e.g., standard vs. reduced rate), you must create new collections.A new tax rule row will appear for this collection under both the base and delivery countries.

- Navigate to:

Products > Taxes - Click + Product Collection

- Enter a title and description

- Click Create

A new tax rule row will appear for this collection under both the base and delivery countries.

Step 2: Assign Tax Percentages

Now configure tax percentages for each collection and delivery country:

- For the base country, check the box with the applicable tax rate.

- For each delivery country:

- If your revenue from that country exceeds €10,000: Check the box for the correct VAT rate.

- If below threshold: Leave the delivery country box unchecked — the base country VAT will apply automatically.

Here’s an example.

Scenario: Your default country is Germany and you’re shipping to Austria and Norway. In Austria you earn a revenue of over 10.000 euros and in Norway, you’re under the threshold amount.

How should the tax percentage boxes be checked for the above scenario?

- For Germany, the highest tax percentage will be applicable for the default category.

- For Austria (since it is over the minimum threshold) check the box for the tax percentage that is applicable for the default category.

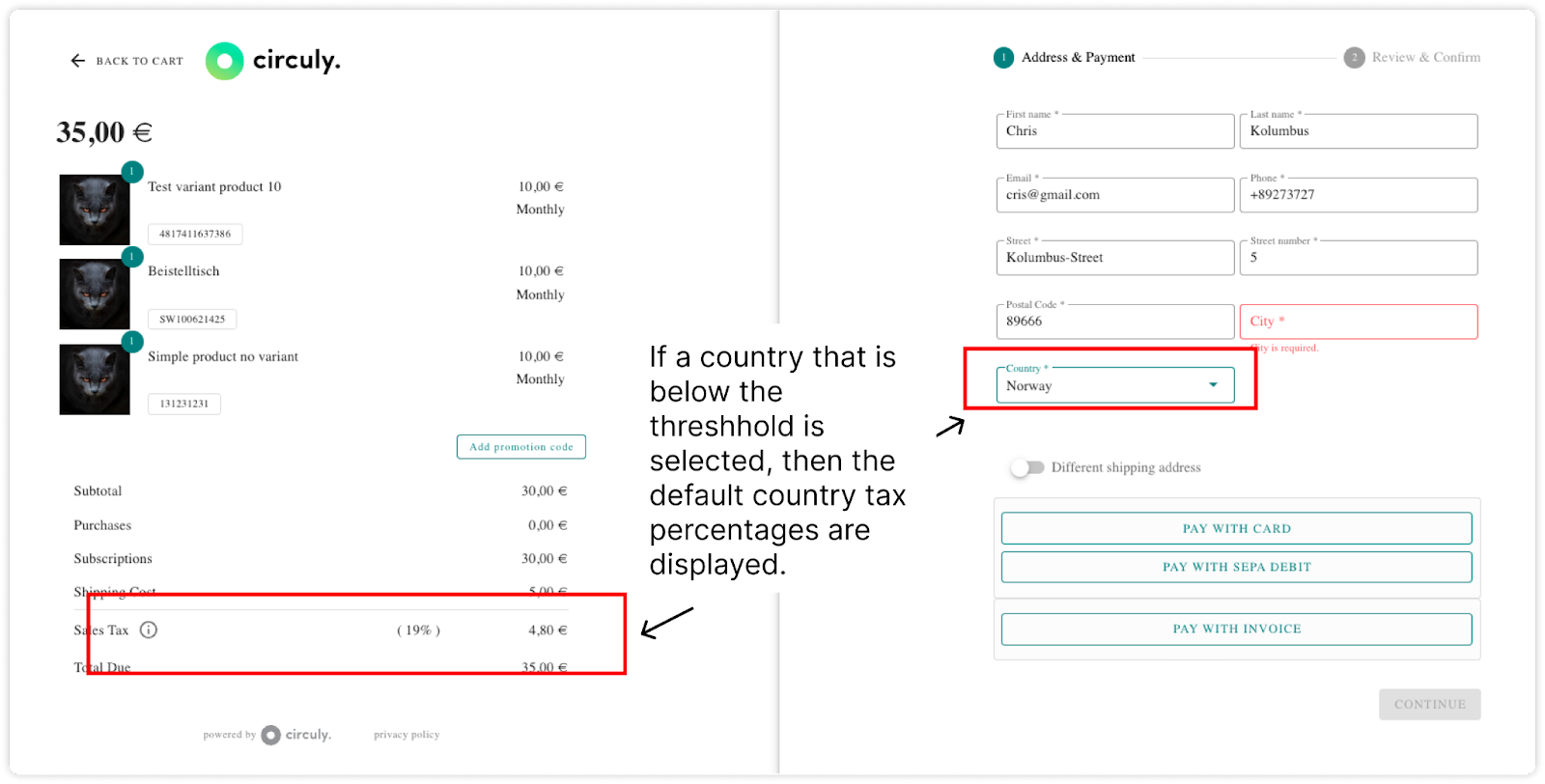

- For Norway (since it is below the threshold) you do not have to check any checkbox. Since the threshold amount has not been reached, the tax rates will be automatically calculated as per the default country.

Step 3: Map Products to Collections

To apply the correct VAT logic, map products to the appropriate collection:

- Navigate to:

Products > Products - Select the products to reassign

- Click Map to Product Collection

- Choose the correct collection from the dropdown

- Click Map to Collection

How tax is applied on the checkout page

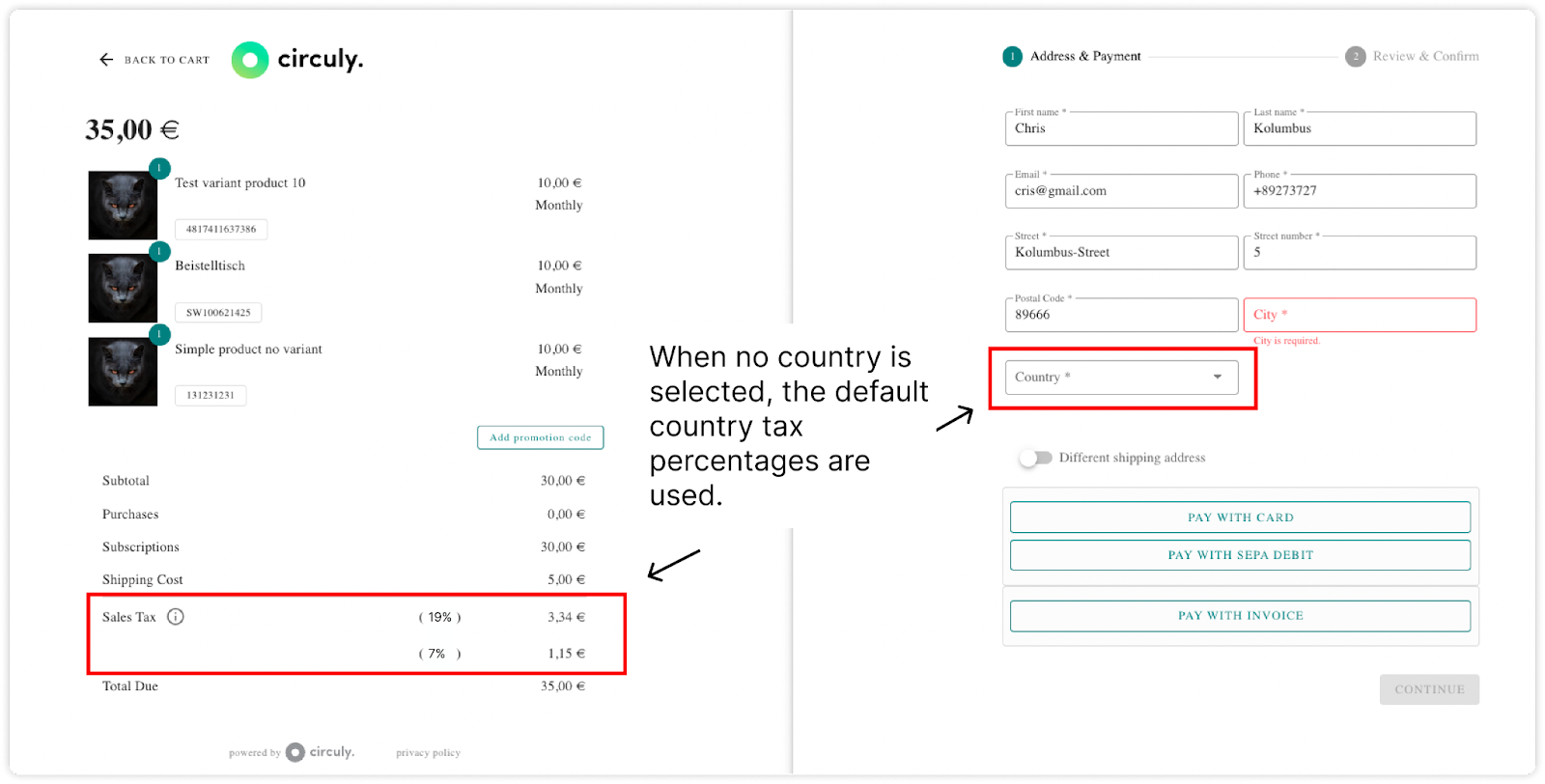

- Before Delivery Country Selection:

- Tax is calculated using your base country rates.

- An info note alerts customers that final tax will update based on delivery country selection.

- After Country Selection:

- Above revenue threshold: Tax from the selected delivery country applies.

- Below revenue threshold: Base country VAT continues to apply.

Important: Tax percentages in circuly are fixed in the system. If your business is enrolled in a special tax program or needs custom rules, contact our service desk for adjustments.

Configuring your tax rules in circuly allows you to operate compliantly across borders while ensuring customers are charged the correct VAT. With automated logic tied to product type, revenue thresholds, and shipping destinations, you can reduce errors, simplify reporting, and deliver transparency at checkout.